Can an insurance company force you to total your car in Denver?

After an accident, an insurance company may suggest that a car be totaled instead of repaired. If you’ve found yourself in this situation, you may wonder if insurance has the final say.

At Zaner Law Personal Injury Lawyers, we see many individuals facing this problem. We understand how stressful it can be to have your vehicle’s condition evaluated after an accident, and we want to help you understand the situation so you can make an informed decision about your car.

If you have any questions about the following information, we invite you to contact us at (720) 613-9706 for a free consultation with our Denver car accident lawyer.

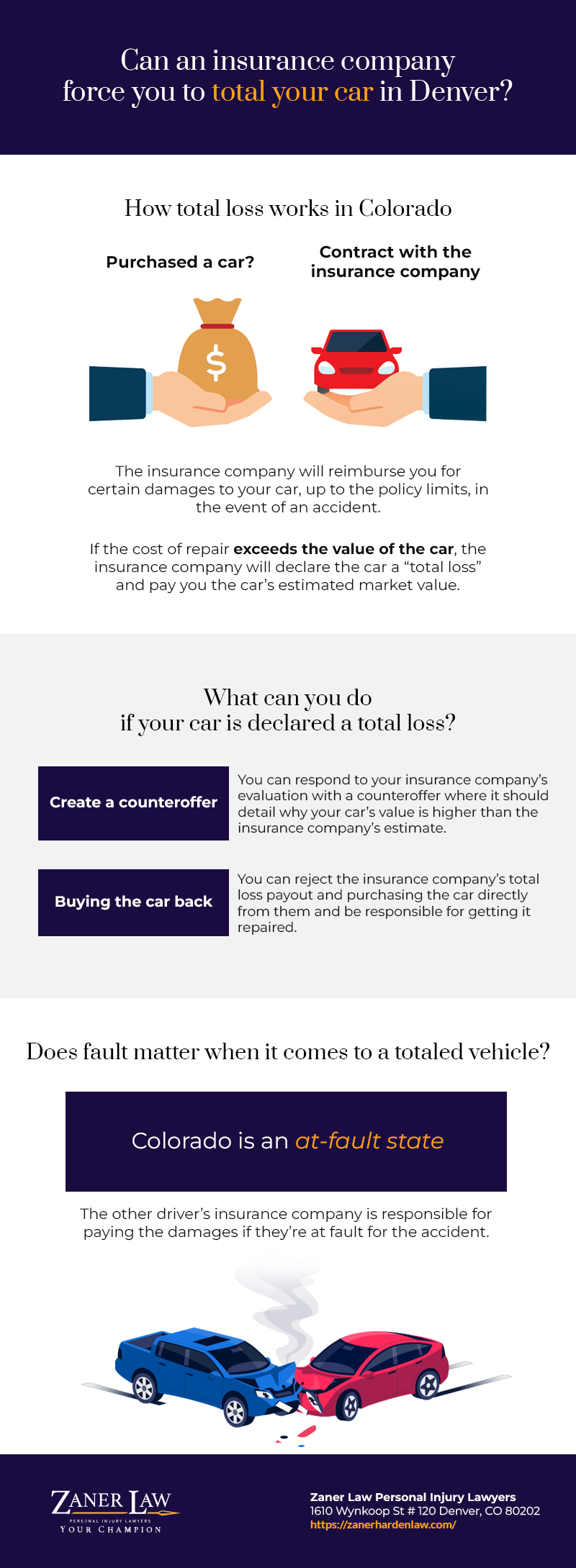

How does total loss work in Colorado?

When you purchase car insurance, you enter into a contract with the insurance company. This agreement states that the insurance company will reimburse you for certain damages to your car, up to the policy limits, in the event of an accident. In return, you pay insurance premiums and abide by the agreement’s conditions.

If you get into an accident, the insurance company will inspect your vehicle to determine the extent of the damage. Then they’ll determine the cost of repair and compare it to the car’s pre-accident value.

If the cost of repair exceeds the value of the car, the insurance company will declare the car a “total loss” and pay you the car’s estimated market value.

For example, if your vehicle was worth $8,000 before the accident, and the cost of repairs is estimated at $9,000, your car would be considered a total loss. You’ll then receive an $8,000 payment minus any deductibles.

This payment will go directly to you if you own the car outright; otherwise, it’ll go to the lender to cover the outstanding loan balance. You’ll likely be expected to leave your car with the insurance company, and they’ll take care of selling or scrapping the vehicle.

What can you do if your car is declared a total loss?

A total loss decision can be a difficult pill to swallow, especially if you’re emotionally attached to the car. And if the amount you owe to your lender exceeds the insurance company’s payment, you’ll be left with a hole in your pocket and no car to show for it.

Unfortunately, your insurance company has the right to declare your car totaled — and refuse to repair it — without your consent. That said, you do have some options if you disagree with their decision, such as creating a counteroffer or considering the option of repurchasing the car.

Create a counteroffer

For starters, you have the right to respond to your insurance company’s evaluation with a counteroffer. This option won’t necessarily save your car, but it could help you get a better payout. Your counteroffer should detail why your car’s value is higher than the insurance company’s estimate.

Information such as the vehicle’s features, recent upgrades, and comparable sales data can all be used to support your claim for a higher payout. You may also want to hire an independent appraiser to accurately evaluate the car’s value.

| A few independent appraisers in the Denver area |

Similarly, it might be worth getting an independent repair quote from a reputable auto body shop to compare with the insurance company’s repair estimate.

If the insurance company’s repair estimate is significantly higher than the independent estimate, you may even be able to argue that the car is repairable and shouldn’t be deemed a total loss.

Consider buying the car back

If the insurance company won’t budge on its total loss evaluation and your heart is set on keeping the car, you may be able to buy it back from the insurance company for its salvage value.

This would involve rejecting the insurance company’s total loss payout and purchasing the car directly from them.

The downside of doing this is that you’ll be responsible for getting the car repaired and restoring it to a drivable condition. Depending on the extent of the damage, this could be extremely expensive — and once the repairs are complete, you still won’t be legally allowed to drive the car without having it inspected and re-titled.

Does fault matter when it comes to a totaled vehicle?

Keep in mind that Colorado is an at-fault state. This means that the other driver’s insurance company is responsible for paying the damages if they’re at fault for the accident.

If another driver’s negligence caused your vehicle’s damage, their insurance company will largely follow the same process outlined above.

There’s just one caveat: The amount you’ll receive is limited to the liability coverage of the other driver’s policy.

In Colorado, the minimum amount of liability coverage for property damage is $15,000. If the other driver has only purchased the minimum coverage amount and your car’s value is higher than $15,000, you may not receive enough to pay off your loan or replace your car.

In that case, you’ll need to explore other compensation options, such as filing a lawsuit against the other driver.

The importance of consulting with a lawyer

It’s wise to seek legal advice when dealing with a totaled car. No matter who was at fault for the accident, an experienced lawyer can help you explore your options for getting the most out of your totaled vehicle.

For instance, they can review your insurance policy to ensure you’re getting the full coverage to which you’re entitled. They can also assist in filing a claim against the other driver if their liability coverage doesn’t cover the full amount of damages.

If you’re concerned about an insurance company’s decision to total your car, Zaner Law Personal Injury Lawyers is ready to help. Our attorneys have years of experience representing victims of car accidents throughout Colorado.

Contact us to learn how we can help you obtain fair compensation for your totaled vehicle.

Contact our Denver Car Accident Attorneys at Zaner Law Personal Injury Lawyers at (720) 613 9706

For more information, please contact the Denver Car Accident lawyers at Zaner Law Personal Injury Lawyers to schedule a free initial consultation with a personal injury lawyer.

We are located in Denver, CO, and proudly serve all of Denver County.

Zaner Law Personal Injury Lawyers

1610 Wynkoop Street, Suite 120.

Denver, CO 80202

(720) 613 9706

Find us with our Geocoordinates: 39.75208145814397, -105.00017355026108

About The Author

Kurt Zaner has earned national recognition for his innovative legal strategies, securing some of the largest verdicts in Colorado. He assists injured clients in Denver with personal injury cases, including car accidents, truck accidents, wrongful death, motorcycle accidents, and more. Click here to view some of the fantastic case results that Zaner Law has successfully handled.

Location: Denver, CO

Justia / LinkedIn / Yelp / Facebook

Car Total Loss Explained – Infographic